Accounting

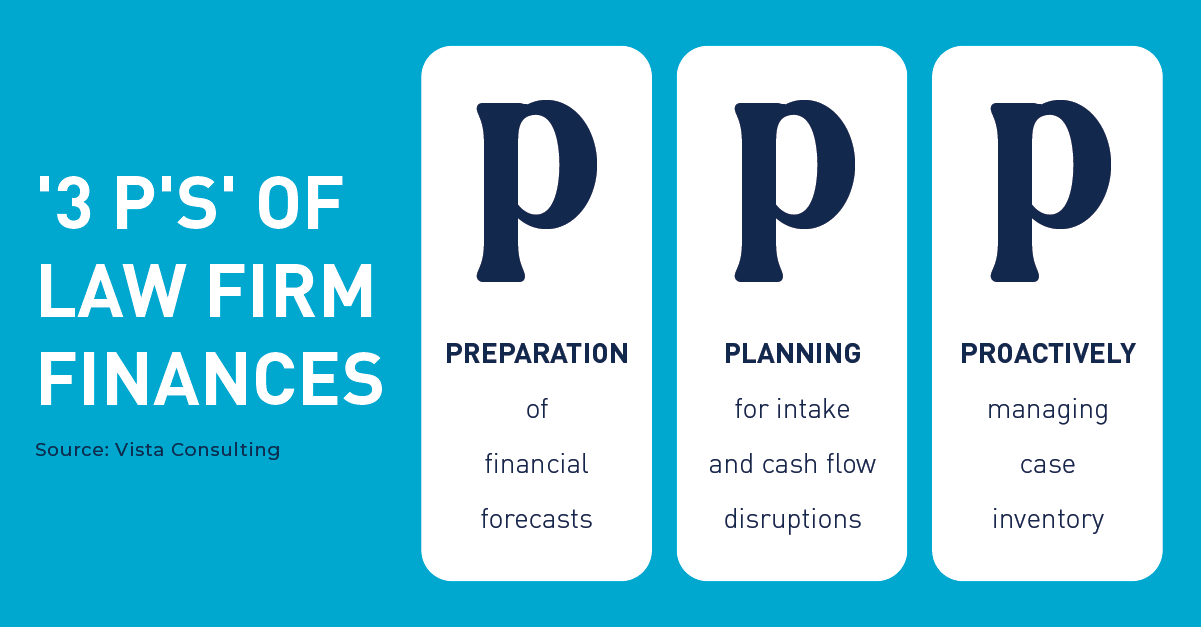

Using the 3 P’s: Preparation, Planning, and Proactivity for Your Firm

In this blog, we discuss the importance of employing The 3 P’s of Law Firm Finances: Preparation, Planning, and Proactivity for your contingency fee law firm, featuring insights from Tim McKey, CEO of Vista Consulting, who authored this article.

As law firms strive to remain competitive in the increasingly heated legal market, the key to surviving – and indeed, thriving – lies in employing the ‘3 P’s’ of law firm finances: Preparation of financial forecasts, Planning for intakes and cash flow disruptions, and Proactively managing case inventory.

Preparation

Firstly, let’s talk about Preparation. In the current, economic environment, liquidity is more important than ever. Ensuring your contingency fee law firm has rigorous financial forecasts in place is a cornerstone of financial preparation. This involves forecasting both the value and duration of your case inventory. It’s also about understanding your short-term cash needs as well as long-term financial projections. By doing so, you put your firm in a better position to invest in growth opportunities, such as modernizing infrastructure or implementing advanced case management systems.

Planning

The second P, Planning, involves understanding your law firm’s cash flow, the irregular flow associated with cases, and anticipating when disruptions may occur. The recent pandemic has taught us that disruptions can come from anywhere, at any time, with court closures and stay-at-home orders impacting intakes and case resolutions. By planning for potential disruptions, you’re playing the long game, ensuring your law firm is prepared to weather any financial storms that might come its way.

Proactivity

Proactivity is about actively taking control of your firm’s financial future. This involves regularly reviewing and updating your case inventory – at least quarterly. It also requires ensuring data integrity and quality in your case management system. The modern law firm that embraces technology and runs more like a business is the one that will pull ahead of its competitors.

Managing a law firm’s finances requires focus and expertise. Many of the top-performing contingency fee law firms we’ve had the pleasure of working with have someone dedicated to managing their firm’s finances. Whether it’s a Chief Financial Officer (CFO), a lawyer with a finance degree, or an external consultant, this individual is tasked with setting goals for the firm and creating a plan to achieve them.

The ‘Three P’s’ of law firm finances – Preparation, Planning, and Proactivity – are essential for any law firm looking not just to survive but to thrive in today’s competitive legal market. By focusing on these areas, you’ll ensure your firm is in a strong financial position, ready to seize growth opportunities and navigate any challenges that come your way

Knowing Your Options for Smart Financing

A basic life principle is that ‘timing is everything’. This is especially true when it comes to law firm growth. While many contingency fee law firms start out by self-financing, they often reach a point when that approach can actually hinder growth, as capital becomes tied up in case resources.

Understanding the value of financing case costs, and when and where to finance is essential. Whether you’re self-financed or borrowing from a traditional bank, specialty finance company, or even Esquire Bank, it’s important to understand the financing options available to you.

This knowledge allows you to leverage your low-cost deposits when applying for a line of credit and helps you make informed decisions about interest rates, fees, collateral requirements, and loan structures. Most importantly, you should ally with a strategic financial partner who understands the unique business model of contingency fee law firms.

Meet with Esquire Bank

Learn how your law firm can leverage case cost financing to free up capital that can be invested in marketing, technology, talent, operations, case acquisition, and scaling law firm growth. Schedule a no-obligation consultation with an Esquire Bank Business Development Officer today at a time convenient to your schedule.

SCHEDULE A MEETING

Looking to Learn More About Law Firm Growth Strategies?

Download the eBook now, “5 Bold Strategies to Grow Your Contingency Fee Law Firm,” to get your hands on our top strategies for achieving exponential growth.

DOWNLOAD EBOOK

The information provided in this blog is provided for general informational purposes only. Some of the information may not be applicable or appropriate for all law firms.

Continue Reading

Accounting

3 Key Strategies for Handling Multi-party Case Settlements

Discover three proven strategies for successfully managing multi-party cases settlements, including multi-party QSFs. Read this blog featuring insights from Milestone, an innovator in post-settlement solutions for mass tort and multi-party litigation.

- Life Cycle Stage: Educated - Best Practices

- Content Tier: silver

- Content Type: blog

You are now leaving Esquire Bank

https://lawyeriq.esquirebank.com