In this blog, we discuss the strategic use of a fractional CFO for plaintiff law firms, featuring insights from Tim McKey, CEO of Vista Consulting, who authored this article.

The role of a Chief Financial Officer (CFO) is undeniably critical in the modern business landscape. As financial demands become more complex and caseloads grow, the need for experienced financial leadership intensifies. However, for many growing law firms, employing a full-time CFO may not be the most feasible or economical solution. Enter the Fractional CFO—a concept that’s gaining considerable momentum.

What is a Fractional CFO?

A Fractional CFO, sometimes referred to as an Outsourced CFO or Interim CFO, is a highly experienced financial professional who provides part-time or project-based CFO services to organizations. They are seasoned experts with a deep understanding of financial strategy, accounting, budgeting, and financial analysis. They analyze and review the financial health and processes of your firm, identifying business value drivers, and make recommendations to incorporate tax planning opportunities.

The financial landscape of a plaintiff law firm is complex and unique, requiring specialized knowledge and experience to navigate effectively. When it comes to the unique intricacies of a law firm’s finances, it’s imperative to work with someone who speaks the language. A Fractional CFO with specialized knowledge can provide insights that are tailored to the realities of a contingency-fee based law firm. They understand the nuances of case costs, trust accounting, and pipeline analysis, and they are equipped to develop strategies and processes that align with these intricacies.

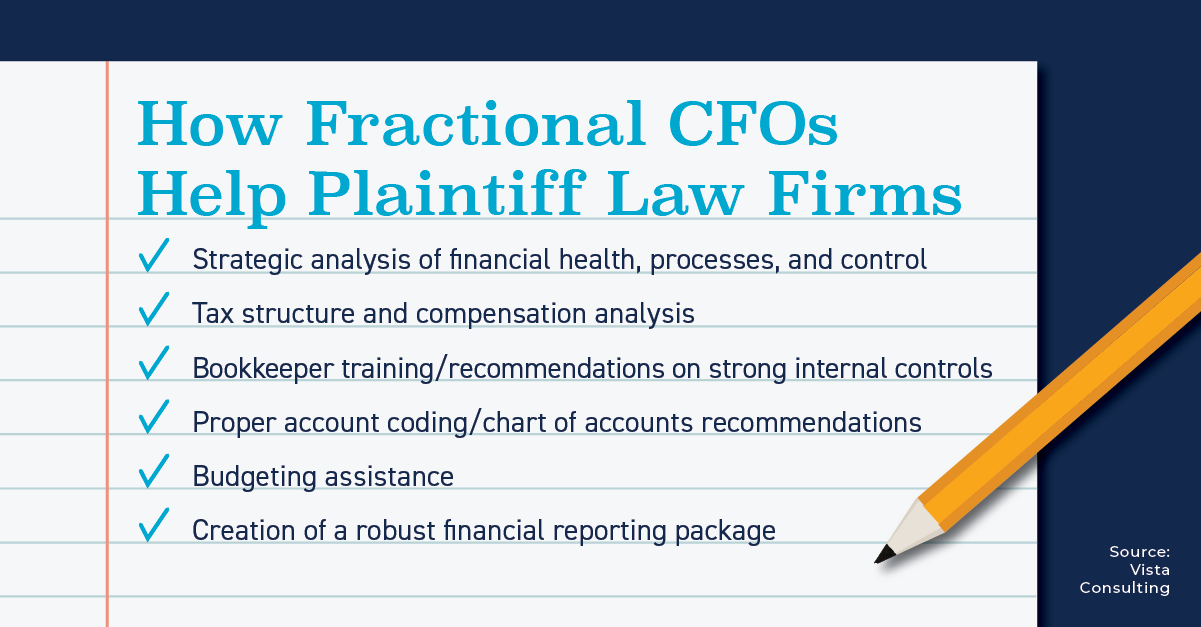

How Fractional CFOs Help Plaintiff Law Firms

- Strategic analysis of financial health, processes, and control

- Tax structure and compensation analysis

- Bookkeeper training/recommendations on strong internal controls

- Proper account coding/chart of accounts recommendations

- Budgeting assistance

- Creation of a robust financial reporting package

Why law firms are gravitating towards Fractional CFOs?

Of course, there is a financial benefit to not having the overhead of a seasoned C-suite professional on your payroll.

Fractional CFOs provides cost-effective expertise. For growing plaintiff law firms, this means tapping into top-tier financial proficiency without overstretching their budgets.

Fractional CFOs offer flexibility. They can tailor their services to meet an organization’s specific needs—be it overseeing financial operations, optimizing financial processes, developing a robust reporting set, or offering strategic financial guidance. This adaptability allows law firms to adjust their financial resources as their needs evolve.

Fractional CFOs provide scalability. Fractional CFOs can effortlessly scale their services up or down as the firm’s requirements change. This adaptability ensures that the firm always has the right level of financial support.

Fractional CFOs help free up team resources. Too, adding a Fractional CFO to your team may allow for greater time and focus for your legal professionals. By entrusting financial management to a Fractional CFO, legal professionals can focus more on their core responsibilities, such as litigation, client representation, and business development. This allows them to do what they do best while leaving financial matters in capable hands.

Fractional CFOs bring a fresh perspective and strategic insights. They can help law firms set and achieve financial goals, manage cash flow effectively, and make informed investments in their growth. Vista Consulting’s Fractional CFOs, for instance, provide key training for bookkeepers, make recommendations on proper internal controls and segregation of duties, and facilitate the integration of QuickBooks with case management software.

A New Era in Law Firm Financial Management

In the dynamic and competitive landscape of plaintiff law, success often hinges on sound financial management. Fractional CFOs provide a practical and strategic solution that empowers growing law firms to maintain financial stability, navigate complex financial challenges, and position themselves for sustainable growth. As firms continue to expand their caseloads and operations, the Fractional CFO option proves itself as a valuable asset in achieving financial success.

Financing Solutions Tailored to Your Law Firm's Needs

Discover how leading contingency fee law firms are succeeding with financing solutions from Esquire Bank. Learn how your law firm can leverage its contingent case inventory to gain access to capital so you can invest in key business areas and drive sustainable law firm growth.

Meet with Esquire Bank

Continue Reading

- Life Cycle Stage: Educated - Product Solutions

- Content Tier: silver

- Content Type: blog