In this blog, we feature insights into how successful plaintiffs law firm owners are leveraging debt to invest in marketing, technology, and talent for their firms.

Whether you want to run more marketing campaigns, hire new talent, invest in tech such as case management systems, or improve operational efficiency and effectiveness by building specialized teams, your law firm needs to have quick and easy access to capital.

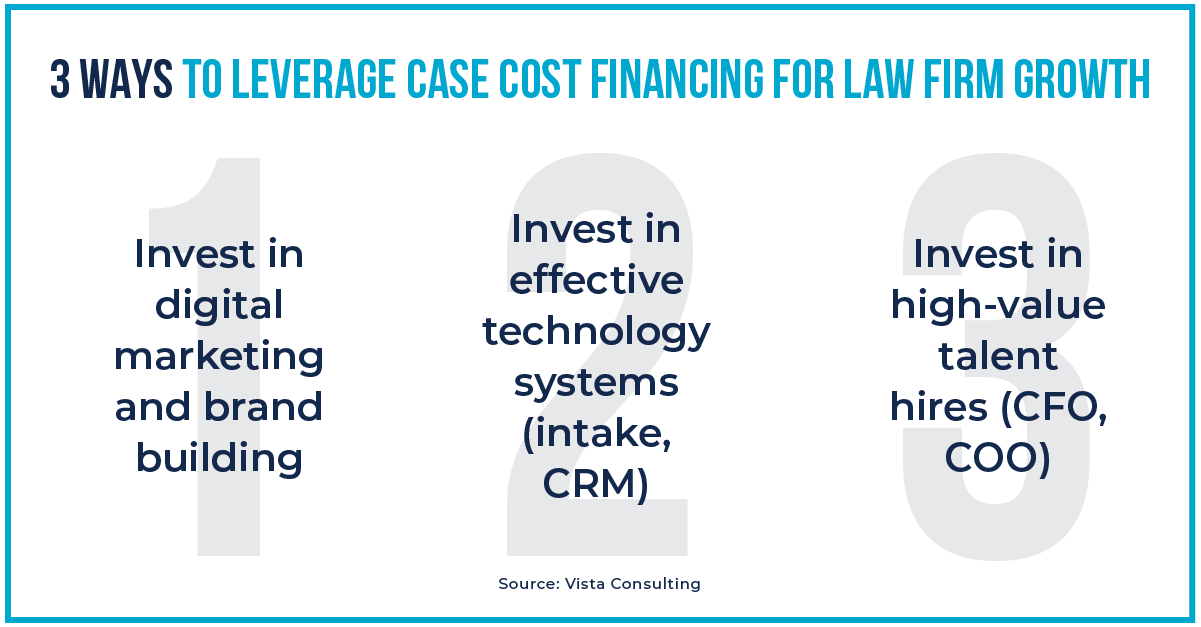

Although all of these investments will vastly improve your business and accelerate growth, if your firm is self-funded, you’re most likely tying up all of your cash in case costs. Money tied up in case costs is money that’s not working to grow your business. Many smart, contingency fee law firm owners have financed their case costs in order to free up cash for business growth. Case cost financing is quickly becoming more common, giving firms that finance their case expenses a leg up on their self-funded peers.

In addition to financing case costs, law firms can also seek other forms of financing such as a Working Capital Line of Credit or a Case Acquisition Line of Credit. For qualifying firms, these additional lines of credit can enable exponential growth by giving law firm owners the flexibility to plan for big purchases such as expensive domain names, pricey but effective technology systems, or high-value talent hires.

Watch the video above to learn how some of our most successful clients are leveraging debt through lines of credit with Esquire Bank to accelerate their growth.

For more on Esquire Bank’s expertise in providing tailored solutions for law firms, please visit Esquire Bank’s resources portal, Lawyer IQ, where you can learn about growing your business, financing for law firms, marketing strategy best practices, and more.

Download the “Typical Lending Options” Infographic

Learn about “Typical Lending Options for Contingency Fee Law Firms” and the value of Esquire Bank’s case cost financing solutions, click below to download

Download InfographicFinancing Solutions Tailored to Your Law Firm's Needs

Discover how leading contingency fee law firms are succeeding with financing solutions from Esquire Bank. Learn how your law firm can leverage its contingent case inventory to gain access to capital so you can invest in key business areas and drive sustainable law firm growth.

Meet with Esquire Bank

Continue Reading

- Life Cycle Stage: Educated - Best Practices

- Content Tier: platinum

- Content Type: video