In this blog, we discuss the importance of financing case costs to free up capital for scaling law firm growth.

The Challenges of Managing Cash Flow

Managing cash flow is a challenge that cannot be ignored for contingency fee law firms. From engaging expert witnesses for litigation cases – such as medical expert witnesses, accident reconstructionists, economists, life care planners, etc. – to processing documents, to a whole host of other related expenditures, the costs can add up quickly. This places an enormous financial burden on plaintiff law firms and their already irregular cash flow.

For many firms, partners shoulder the burden of financing caseloads out of their own pockets. Some self-financed lawyers may even be proud of the fact that they’ve never sought financing. But make no mistake—law firms cannot realize full growth and revenue potential without growing their case load inventory, and this requires capital.

Recognizing the Need to Fuel Growth Through Financing Case Costs

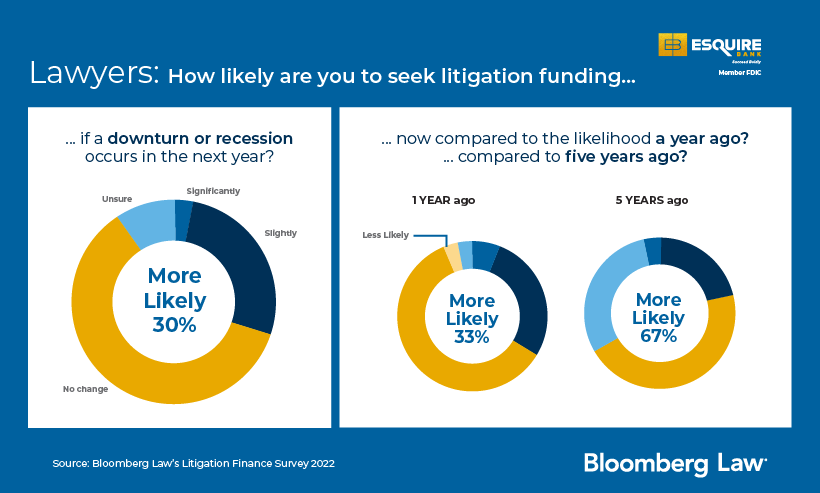

Today’s smart firms are re-evaluating their business models and considering using outside capital to scale law firm growth. Responses to the Bloomberg Law 2022 Litigation survey results indicate a steady pattern of interest and acceptance among law firms in recent years: Two-thirds of firms are more likely to seek financing now than they were five years ago. And the forward-looking picture is good for the industry as well: Of the lawyers who have used litigation finance, about three-quarters say they are likely to use it again.

More importantly, 88% of the respondents indicated that litigation finance enables better access to justice – a point that many plaintiffs law firms often cite when attributing case cost financing to leveling the playing field against corporate goliaths.

Financing Flexibility Leads to a Competitive Edge

While taking on financing may seem daunting, many lawyers nationwide have financed case costs for decades. In fact, leading contingency fee lawyers who financed their case costs have noted that their clients benefit from the new financing model thanks to the capacity to use better tools, hire experts, and bring more resources to bear, which can lead to more profitable outcomes.

In addition, managing cash flow can broaden the law firm’s work on behalf of their business and their clients. Bear in mind that some clients are matched against large and well-funded defendants, such as insurance companies, self-insured corporations, and public entities.

Taking on financing can also provide contingency law firms with a competitive advantage.

Since allying with Esquire Bank in 2016, Edelman & Edelman has avoided the crushing charges specialty law firm funding companies typically charged for case cost borrowing. Instead, the law firm uses the funds it would have otherwise had to spend on case costs to invest in growth and pay operational costs.

“Esquire Bank is not just special, they’re unique,” remarked Martin Edelman, co-founder of Edelman & Edelman, who attributes part of his law firm’s success to Esquire Bank. “What Esquire Bank has given me, besides peace of mind, is the ability to fund cases at a level where I can be more than competitive with my adversaries, I can overwhelm them.”

Firms That Finance Have Options…and Financial Flexibility

When law firms take on outside financing, they are in the driver’s seat. They can choose which cases and costs to finance, as well as disbursement schedules, making sure interest is paid only on the funds being used.

The best financing partners typically offer two methods of case cost financing:

- Case disbursement line of credit with case-level support

- Case disbursement line of credit

Case cost financing solutions provide a range of options for law firms and their litigation funding needs. By offering a master line of credit specifically for case costs, and providing tools to monitor, track and manage the related financial accounting, all provided with low, competitive bank rates, case cost financing from a bank provides a tremendous opportunity that derives benefits to law firms looking for greater business agility, growth and client impact.

Traditional banks, for the most part, have no specific expertise in lending against contingency fee practices. They typically lend based on the firm’s financial history and past performance, rather than projected fees of current and future cases. Or, if they do extend credit, the personal assets of the partners are often required as collateral.

For firms looking to achieve scaling law firm growth, this is challenging. That is why it is critically important for contingency fee firms to explore typical lending options and alternatives that can give them access to new capital and support the firm’s growth in the long term.

Looking to Learn More About Law Firm Growth Strategies?

Download the eBook now, “5 Bold Strategies to Grow Your Contingency Fee Law Firm,” to get your hands on our top strategies for achieving exponential growth.

Download eBookMeet with Esquire Bank

Learn how your law firm can leverage case cost financing to free up capital that can be invested in marketing, technology, talent, operations, case acquisition, and scaling law firm growth. Schedule a no-obligation consultation with an Esquire Bank Business Development Officer today at a time convenient to your schedule.

Meet with Esquire Bank

The information provided in this blog is provided for general informational purposes only and is not intended as, and should not be relied on for, law firm operations, tax, legal or accounting advice. . Some of the information may not be applicable or appropriate for all law firms. Please consult your own tax, legal and accounting advisors as appropriate.

Continue Reading

- Life Cycle Stage: Educated - Product Solutions

- Content Tier: silver

- Content Type: blog