In this blog, we discuss the five keys to maximizing intake conversions for personal injury law firms, featuring insights from Mary Ellen Murrah, operations consultant from Vista Consulting, who authored this article.

The backbone of every personal injury law firm lies in the strength of its intake department. That department is where potential clients form their first impressions of your firm and decide whether they’ve found the right team to help them. To ensure your intake department delivers the return on investment you expect, it’s crucial to optimize the process for turning intakes into conversions.

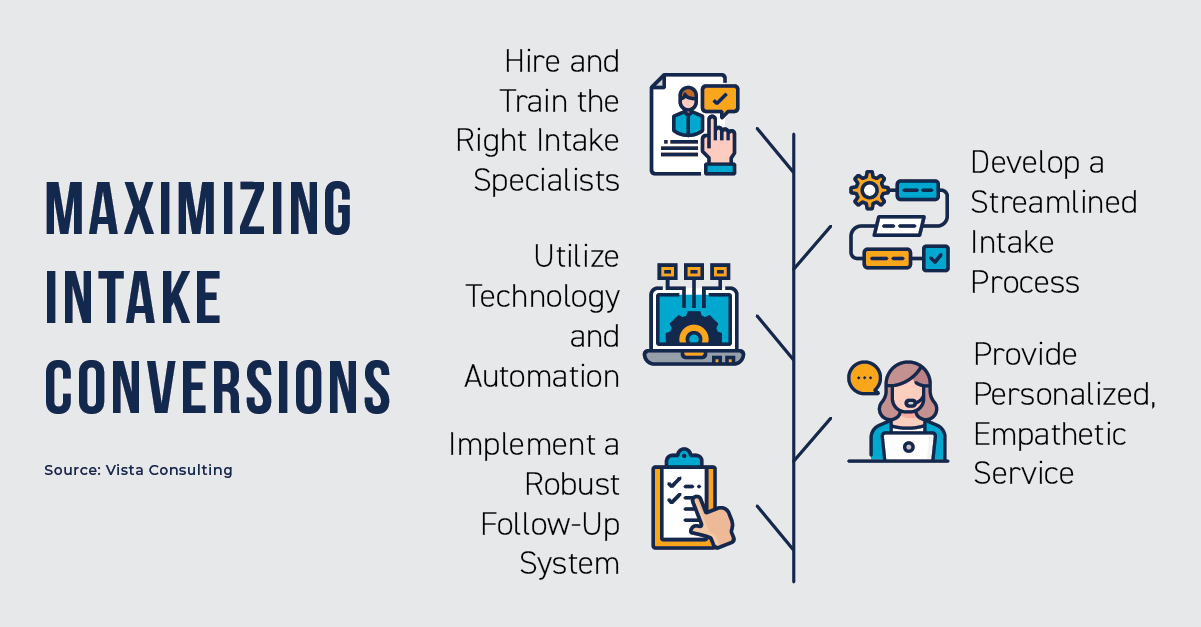

There are five keys to maximizing intake conversions for personal injury law firms to achieve higher conversion rates and secure more cases.

1. Hire and Train the Right Intake Specialists

- Intake specialists are the beating heart of your intake department and the face of your firm to potential clients. Recognize and respect their role.

- Invest in hiring empathetic, confident, and knowledgeable specialists who can effectively collect key information while reassuring potential clients.

- Provide ongoing training to keep your specialists up-to-date on industry trends, firm events and marketing, legal knowledge, and best practices in client communication.

2. Develop a Streamlined Intake Process

- Establish a clear, efficient intake process to ensure consistent, high-quality interactions with potential clients.

- Identify “closers” on your intake team and use them to convert “on-the-fence” potential clients quickly and efficiently.

- Continuously evaluate and refine the process based on feedback and performance metrics.

3. Utilize Technology and Automation

- Implement tech solutions, like CRM software and automated workflows, to streamline the intake process and minimize human error.

- Use automation tools to your advantage and augment your personal follow-up communication appropriately to ensure timely engagement with potential clients, increasing the likelihood of conversion.

- Monitor key performance indicators (KPIs) to track the effectiveness of your intake process and identify areas for improvement.

4. Provide Personalized, Empathetic Service

- Train intake specialists to actively listen and empathize with potential clients’ situations, demonstrating genuine care and understanding.

- Personalize communication by addressing potential clients by name and referencing specific details about their cases.

- Offer immediate assistance and guidance, positioning your firm as a trusted ally in their pursuit of justice.

5. Implement a Robust Follow-Up System

- Develop a systematic follow-up process to maintain engagement with potential clients who haven’t yet committed to your firm.

- Schedule regular check-ins via phone calls, emails, and text messages to provide updates and demonstrate your firm’s commitment to their case.

- Track the success of your follow-up efforts and adjust your approach as needed to optimize conversion rates.

By successfully implementing these tips, you can transform your intake process and turn potential clients into conversions. Remember, it’s not just about collecting information but also about building trust and confidence in your law firm from the very first interaction. Stay proactive, invest in your team, and continuously refine your intake process to achieve optimal results.

To learn more about maximizing intake conversions, watch this video featuring Gary Falkowitz , president of Intake Conversion Experts, as he discusses the impact of increased competition for clients.

For more on Esquire Bank’s expertise in providing tailored solutions for law firms, please visit Esquire Bank’s resources portal, Lawyer IQ, where you can learn about growing your business, financing for law firms, marketing strategy best practices, and more.

Download the “Typical Lending Options for Contingency Fee Law Firms” Infographic

To learn about “Typical Lending Options for Contingency Fee Law Firms”, click below to download

Download InfographicFinancing Solutions Tailored to Your Law Firm's Needs

Discover how leading contingency fee law firms are succeeding with financing solutions from Esquire Bank. Learn how your law firm can leverage its contingent case inventory to gain access to capital so you can invest in key business areas and drive sustainable law firm growth.

Meet with Esquire Bank

The information provided in this blog is provided for general informational purposes only and is not intended as, and should not be relied on for, law firm operations, tax, legal or accounting advice. . Some of the information may not be applicable or appropriate for all law firms. Please consult your own tax, legal and accounting advisors as appropriate.

Continue Reading

- Life Cycle Stage: Educated - Best Practices

- Content Tier: platinum

- Content Type: blog